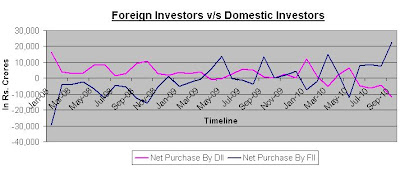

One should now get used to increased speculation and volatility in domestic markets, as they are domestic no more; international is their new citizenship.

We are still to break down all barriers of information sharing and thus leading to an admirable state which economists call “perfect competition”. Many books have been written on the fact that globalization essentially is based on free market philosophy and has its roots in perfect competition. And so when people look at global finance, I feel they miss out on the basic assumptions of perfect completion or free markets or globalization. First, that information on prices, transactions and products are well known to all market participants.

The second assumption is that there are no transaction costs. But, in reality, today transaction costs are very high, eating into the investor’s margin. Ranging from consultancy fees, to trading fees, incoherent tax laws and legal charges; costs are higher for attracting foreign investors. Thus I reiterate that there is no level playing field.

The point I am trying to make here is that foreign investors have little (if not more) confidence and expertise while investing in developing markets. For instance, some stock analysts in India

I feel we have a long way to go to see the full effects of a truly ‘free and flat’ global finance. One should now get used to increased speculation and volatility in domestic markets, as they are domestic no more; international is their new citizenship. Till the time we see some global regulations and standards in capital markets, like we have seen in the banking sector, investors should be worried.